Ann Miura-Ko is a co-founding partner at Floodgate, a seed-stage VC firm. A repeat member of the Forbes Midas Listing and the Contemporary York Times Top 20 Mission Capitalists Worldwide, she earned a PhD in math modeling of cybersecurity at Stanford University.

Extra posts by this contributor

Hi, I’m Ann.

I became one of basically the major investors in Lyft, Refinery29 and Xamarin. I’ve been on the Midas Listing for the past three years and became no longer too long previously named on The Contemporary York Times’ list of The Top 20 Mission Capitalists. In 2008, I co-founded Floodgate, one of basically the major seed-stage VC funds in Silicon Valley. In incompatibility to most funds, we make investments completely in seed, making us consultants to to find product-market fit and building a minimal viable company. Seed is largely quite just a few from later phases, so we’ve made it extra than a uniqueness: It’s all we model. Each and every of our partners sees thousands of companies yearly sooner than electing to make investments in finest the pause three or four.

For the past 11 years, I’ve invested on the inception phase of startups. We’ve seen startups lumber wildly correct (Lyft, Refinery29, Twitch, Xamarin) and wildly ghastly. After I reflect on the failures, the muse cause inevitably stems from misconceptions all the contrivance in which throughout the personality of product-market fit.

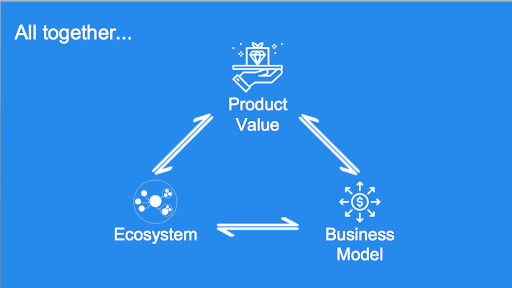

Sooner than making an strive to scale your minimal viable product, you’ll want to always focal level on cultivating your minimal viable company. Nail down your mark proposition, get hang of your apartment in the broader ecosystem and craft a alternate mannequin that provides up. In other phrases, staunch product-market fit is in actuality the magical second when three ingredients click collectively:

To have constructed a minimal viable company, these three ingredients must work in live efficiency collectively:

- Other people must mark your product ample to be appealing to pay for it. This mark furthermore determines how you equipment your product to the area (freemium versus free to pay versus endeavor gross sales).

- Your alternate mannequin and pricing must suit your ecosystem. They need to furthermore generate ample gross sales quantity and earnings to protect your alternate.

- Your product’s mark must fulfill the needs of the ecosystem and the ecosystem needs to accept your product.

Many entrepreneurs conceptualize product-market fit because the level where some subset of customers fancy their product’s functions. This conceptualization is harmful. Many failing companies have functions that customers cherished. Some even have multiple loved functions! Expansive functions constitute finest one-half of of 1-third of your total puzzle. To have created a minimal viable company, a company needs all three of these ingredients — mark propositions, alternate mannequin and ecosystem — working in live efficiency.

So founders seize tag…

Coming into into “negate mode” whereas lacking any of these ingredients is building your organization on an unsound foundation.

Founders who tune out basically the most original tweet cycle on “the secrets and ways to elevating Sequence A” and focal level as an different on the intricacies of their include alternate will get hang of that product-market fit is a predictable, achievable phenomenon. On the different hand, founders who prematurely focal level on negate without incandescent the original ingredients of their minimal viable company gradually gasoline an addictive and unfavourable cycle around their alternate’ false negate, shopping non-optimal customers that make contributions to their company’s destruction.

Be taught an prolonged version of this article on Extra Crunch.