Personal finance startup Truebill announced today that it has raised $15 million in Series B funding.

The new funding was led by Eldridge Industries, with participation from Evolution VC and previous investors, including Cota Capital, Lucas Venture Group and YouTube co-founder Jawed Karim.

When the Y Combinator-backed startup raised seed funding back in 2016, it was focused on what Chief Revenue Officer Yahya Mokhtarzada now describes as “a single function” — helping users track all their subscriptions and recurring expenses, and then to cancel them when desired.

Mokhtarzada said the Truebill team subsequently saw an opportunity, given “the increasing degree of financial complexity in people’s lives,” to take “a more holistic view of personal finance.”

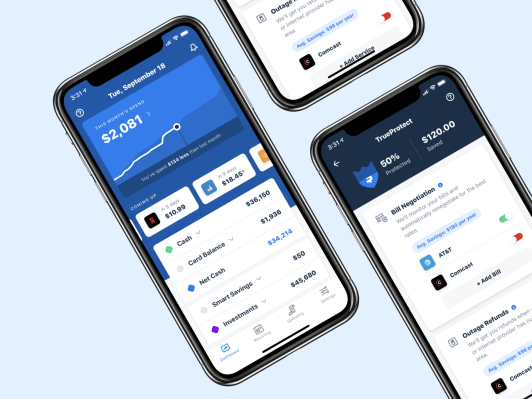

Truebill still offers subscription tracking, and Mokhtarzada said that’s usually what brings new users in. But it’s also added capabilities like automated budgeting, automated saving and bill negotiation. And this fall, it plans to launch additional features, including bill pay, credit score monitoring and a rewards program.

Consumers have plenty of other personal finance tools to choose from, but Mokhtarzada said most of them are focused on fulfilling a specific need and will likely become less relevant as your financial situation changes.

“The other half is, if you look at the App Store, it’s filled with single point solutions,” he said. “As your financial life gets more sophisticated and complex, the consumer is ending up with five or more different point solutions. All of that needs to be consolidated into one place.”

Truebill says it currently has 500,000 active users. The basic product is free, then users can pay a price of their choosing for premium features like custom budget categories; Truebill also takes a cut of the savings when it negotiates lower bills.

The company recently opened new headquarters in Silver Spring, Md. Mokhtarzada said Truebill still has an office in San Francisco, but he noted that he and his co-founders/brothers previously built Webs.com in Silver Spring.

“San Francisco obviously has a very competitive market — it’s harder to hire and very difficult to retain talent,” he added. “With the D.C. area, it feels like we’ve found an untapped market, with very talented engineers working for the government, working in an area of technology that’s not very exciting for them.”