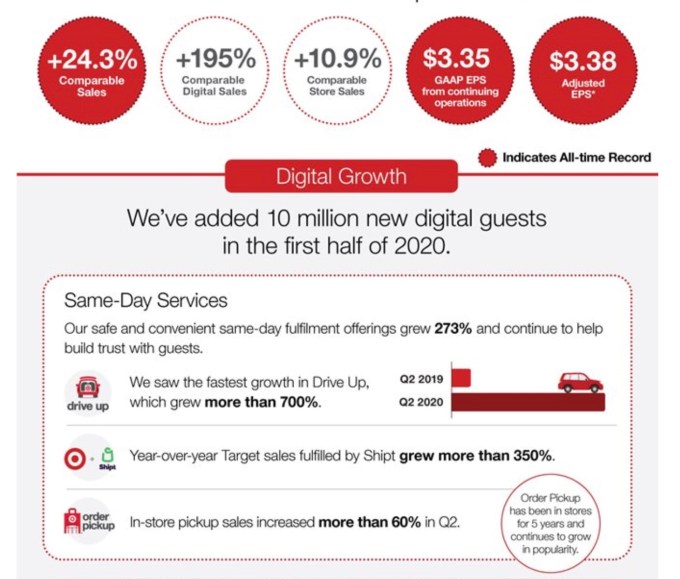

Following Walmart’s pandemic-fueled earnings beat posted on Tuesday, Target this day also handily beat Wall St. expectations to bring a document-setting quarter across a assortment of key metrics. The retailer on Wednesday presented its strongest quarter up to now for comparable sales, which grew 24.3% in Q2, utilizing Target’s revenue up 80.3% year-over-year to $1.69 billion. Online ordering turn out to be namely smartly-liked, Target smartly-known, with digital sales rising 195%. Same-day products and services savor Pressure Up, Order Purchase Up and Shipt also grew by 273%.

Within the quarter, Target topped estimates for revenue, same-store sales, adjusted EPS, and gruesome margin. It reported $23 billion in revenue, vs. estimates of $19.82 billion. Its document-settinbg 24.3% lift in comparable sales turn out to be smartly above the anticipated 5.8%. Earnings per portion came in at $3.38 vs. the $1.58 forecast. And its GM turn out to be 30.9% as a substitute of the anticipated 28.98%.

The firm attributed its sales growth to a assortment of factors, alongside side its skill to live open amid the pandemic as an predominant industry, its customers’ overall belief within the Target stamp, its skill to come by customers to store across its product categories, its digital products and services, and most notably, the return of customers to its stores in Q2.

The latter item doesn’t necessarily imply Target shoppers were walking the aisles, on the opposite hand.

Instead, it speaks the investments Target made earlier than the pandemic in bridging the outlet between online ordering and its bodily stores. In Q2, Target’s In-store Order Purchase Up grew bigger than 60%, as shoppers headed interior Target to take up their web orders, as an illustration.

Target’s Pressure Up provider, which enables customers to store online then pull up in designated parking spots to non-public orders introduced their vehicle, turn out to be up by bigger than 700% within the quarter.

And Target’s Shipt same-day home supply provider Shipt turn out to be up 350% over final year.

Which implies that for a lot of what Target customers think as “online procuring,” their sales were in truth being fulfilled by Target’s stores. In actuality, Target mentioned its stores fulfilled bigger than 90% of its 2d-quarter sales.

Image Credits: Target

To originate out its digital fulfillment products and services, Target took a tech firm-savor skill in leveraging interior engineering groups able to iterating rapidly on contemporary strategies. A personnel of eight, alongside side four engineers, at the foundation constructed Pressure Up starting up attend in April 2017, for instance. By summer 2017, Pressure Up turn out to be being examined in internally. It then rolled out to Target’s home market by that plunge. And as of August 2019, Target’s Pressure Up provider turn out to be on hand nationwide.

The retailer has also made key acquisitions to aid its e-commerce operations, alongside side its $550 million deal for Shipt in 2017, and more recently, its acquisition of same-day supply abilities from Deliv attend in Could. It has also integrated Shipt’s same-day provider straight into its comprise web pages and app, as a substitute of relying best seemingly on Shipt’s dedicated stamp to attain Target shoppers.

The outcomes of those efforts are in truth paying off in an epidemic where customers don’t necessarily must browse stores’ aisles in-person to store. And that has resulted in Target seeng what Yahoo Finance this day described as “tech firm-savor growth” for its retail industry.

Store opening at Target Houston – Richmond on Wednesday, Nov. 8, 2017 in South Richmond, Texas. (Anthony Rathbun/AP Photos for Target)

Target’s Chairman and CEO Brian Cornell furthermore smartly-known the firm has added $5 billion in market portion within the indispensable 6 months of 2020, for the length of which length it’s added 10 million contemporary digital customers.

“Our 2d quarter comparable sales growth of 24.3 percent is the strongest now we non-public ever reported, which is a correct testomony to the resilience of our personnel and the sturdiness of our industry mannequin. Our stores were the principle to this unparalleled growth, with in-store comp sales rising 10.9 percent and stores enabling bigger than three-quarters of Target’s digital sales, which rose virtually 200 percent,” he mentioned. “We also generated prominent profitability within the quarter, at the same time as we made indispensable investments in pay and benefits for our personnel. We live steadfast in our middle of attention on investing in a right and handy procuring abilities for our company, and their belief has resulted in market portion gains of $5 billion within the indispensable six months of the year,” Cornell persevered.

“With our differentiated merchandising assortment, a total role of handy fulfillment choices, a right steadiness sheet, and our deeply dedicated personnel, we are smartly-geared as a lot as navigate the ongoing challenges of the pandemic, and continue to grow profitably within the years forward,” he mentioned.

The pandemic has carried out a role in what customers bought, too. Target mentioned its sales were up across all 5 of its core merchandise categories. This turn out to be led by the strongest sales in electronics, a class that turn out to be up 70% year-over year consequently of of us staying at home for work, college and entertainment, leading to more purchases of things savor computer programs or gaming programs. Electronics were followed by home merchandise, which were up by 30%, then increases of 20% for the beauty, food & drinks, and essentials categories. Attire even shifted from a 20% decline in Q1 to double-digit growth in Q2. Buyer basket dimension also grew 18.8%, as of us shopped for more items on their Target runs.

Devour Walmart, Target also saw a desire from government stimulus assessments, which will seemingly taper off subsequent quarter. But Target declined to provide extra 2020 guidance, asserting that the COVID-19 crisis makes client procuring patterns and government policies unpredictable.