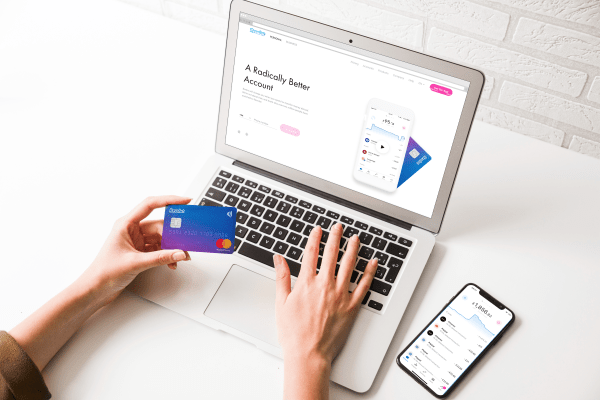

London-based fintech startup Revolut has two pieces of news to announe this week. First, Revolut is expanding to Singapore after a long beta period. The company already has 30,000 customers over there and anyone can open an account now.

Singapore residents will be able to take advantage of all of Revolut’s core features. You can open an account from your phone, get a card and start spending anywhere in the world.

Revolut supports Singapore Dollar as well as 13 other currencies. You can top up your account, send and receive money from the app.

With a free account you can convert money in the app without any markup fee on weekdays up to S$9000 per month. You can also withdraw money anywhere in the world without any fee up to S$9000 per month.

Premium accounts cost S$9.99 per month and Metal accounts cost S$19.99 per month in Singapore. You get higher limits and a few additional features.

Revolut is currently available in the U.K., Europe and Australia. There are 7 million Revolut customers in total. The company is still working on its launch in the U.S. and Canada for later this year.

The other piece of news is that Revolut has signed a global partnership with Mastercard. Revolut has already been working with Mastercard to issue cards, so this is an expansion of the current deal.

Revolut can now issue cards that work on the Mastercard network in any market where Mastercard is accepted, which represents around 210 countries. It doesn’t mean that Revolut will launch in 210 countries. But the startup says that the first Revolut cards in the U.S. will work on Mastercard.

It also doesn’t mean that Revolut will work exclusively with Mastercard. The company also works with Visa and recently announced a partnership deal. But at least 50% of all existing and future Revolut cards in Europe will be Mastercard branded.

It shouldn’t matter much to end customers as I have yet to see a place that accepts Mastercard but not Visa, or Visa but not Mastercard. But Revolut is clearly using market competition to its advantage.