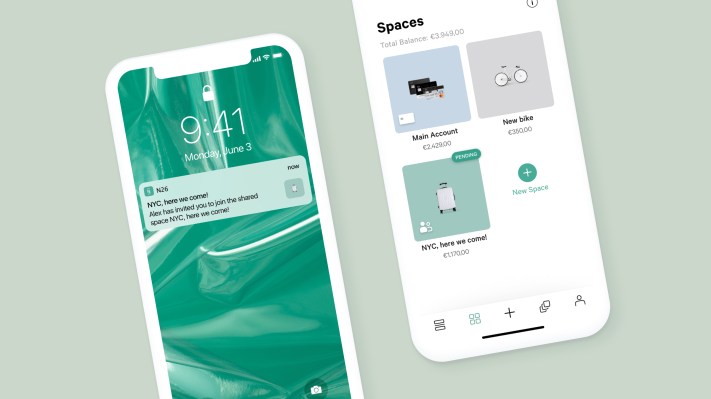

Challenger bank N26 is announcing two things this week. First, the company lets you share sub-accounts with other N26 users in just a few taps. Second, after a limited beta test, the company is officially launching in the U.S. with open registration.

Shared Spaces could be seen as an alternative to joint accounts. The feature could be particularly useful for groups with more than 2 persons and situations that temporarily require a shared account. For instance, you could use Shared Spaces for a vacation, to split bills with your roommates, etc.

Only a small subset of the company’s user base can access the feature for now. N26 plans to gradually roll out Shared Spaces to all users.

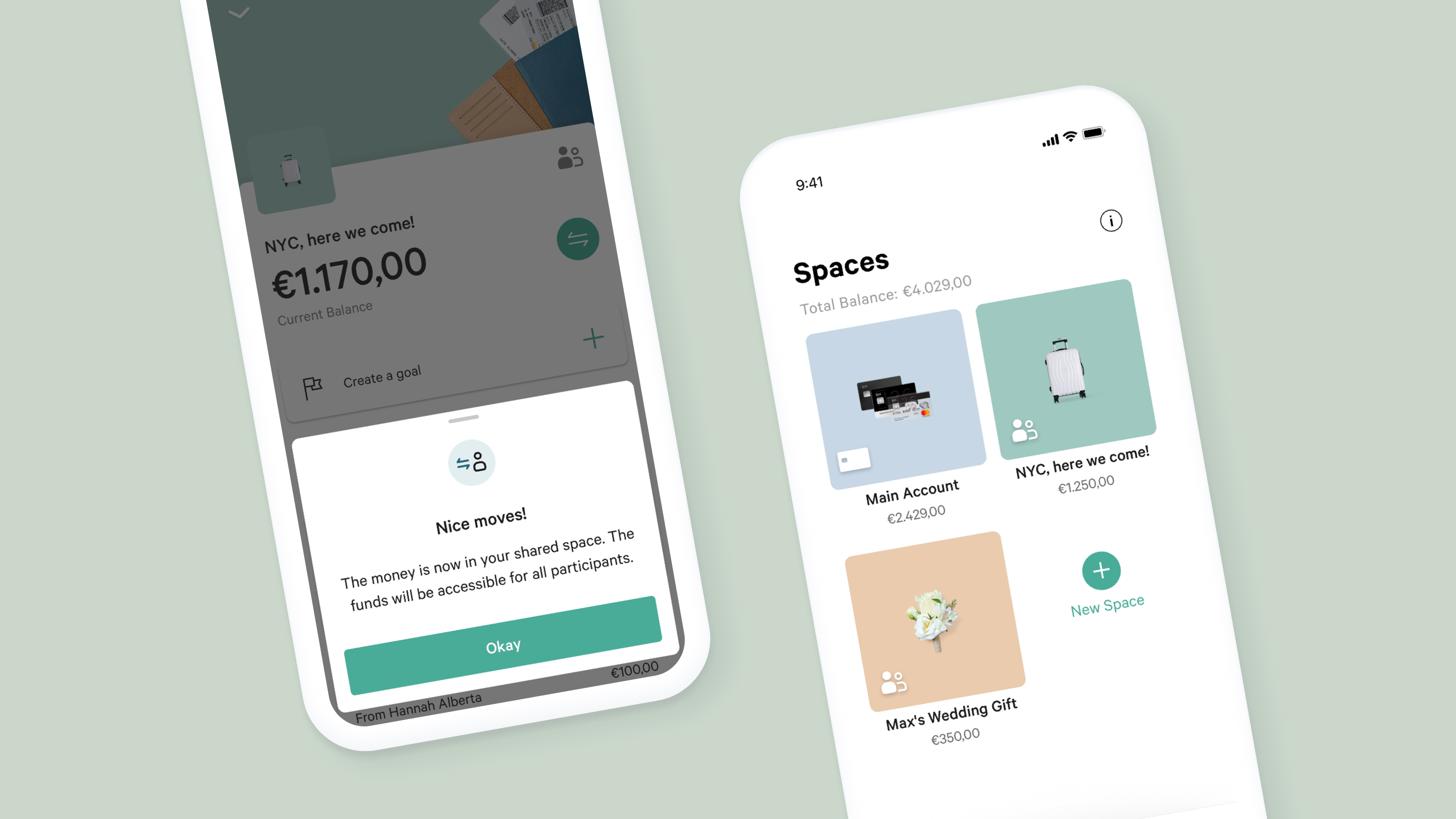

The company is building this feature on top of Spaces. This feature has been around for a while. It lets you create a sub-account and set aside some money in that separate sub-account. You can set savings goal and transfer money on a regular basis.

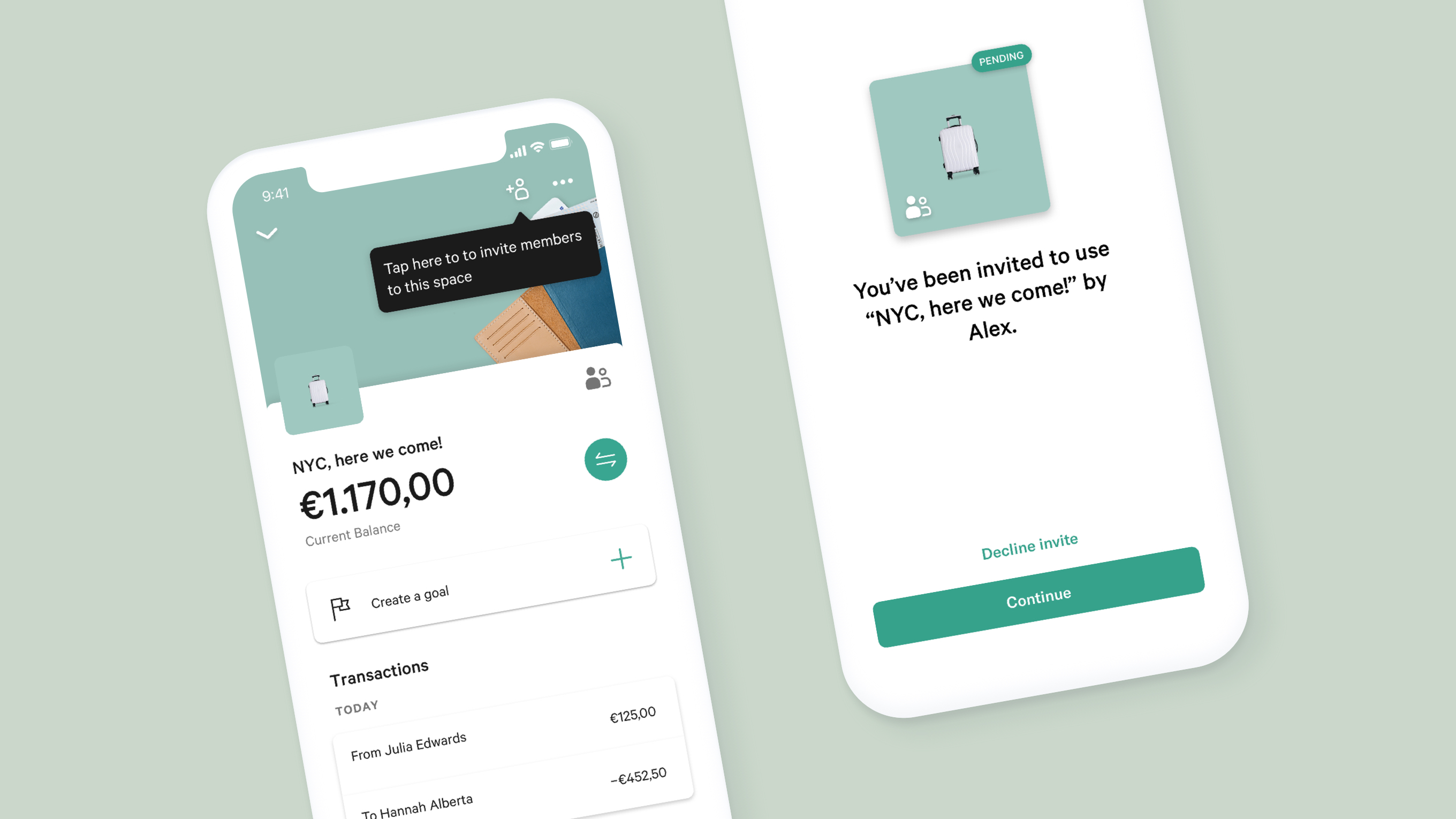

Shares Spaces is basically a multiplayer version of Spaces. When a user creates a Space, they can invite up to 10 other N26 users to that Space. While the original user remains the owner of the Space, other users can freely deposit and withdraw money from the shared account.

Sending an invite is the equivalent of granting a power of attorney on a Space. The admin of the Shared Space is the only person who can add and remove participant to the Shared Space. So it’s not technically a joint account as joint accounts have multiple owners.

Interestingly, N26 is launching this as a premium feature. You need a premium N26 account in order to create a Shared Space, such as an N26 You subscription (€9.90 per month) or an N26 Metal subscription (€16.90 per month). You can invite free users, but free users are limited to two active Spaces. Those limitations will most certainly foster premium subscriptions.

Unfortunately, you can’t spend money from a Shared Space directly for now. Your card and bank transfers remain tied to your main N26 account. You have to tap on a transaction and tap on “Pay back from a space” to get your money back from a Shared Space.

N26 co-founder and CEO Valentin Stalf told me that there could be a feature that lets you attach different cards to different Spaces in the future.

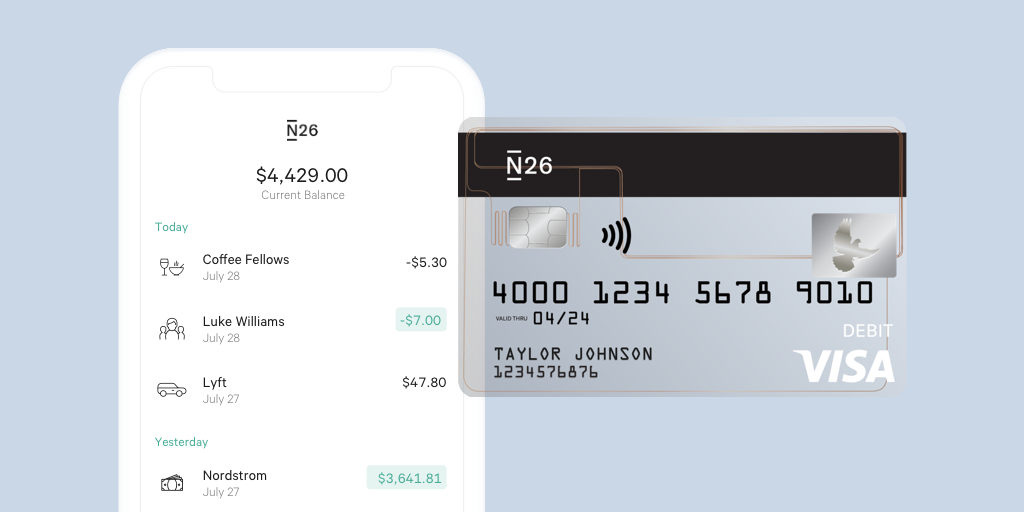

When it comes to the U.S., N26 started accepting customers in the U.S. in early July. And it looks like it’s been working well as anyone in the U.S. can now download the app and open a bank account. N26 is also launching MoneyBeam in the U.S., a Venmo-like feature that lets you instantly send money to other N26 users.

N26 is also launching perks in the U.S. You’ll get small discounts on some monthly subscriptions if you pay with your N26 card. Current partners include Aaptiv, Blinkist, Luminary and Tidal.

I already coved the U.S. launch back in July, so head over to my previous article to learn more.