Fearing frail fundraising alternatives within the wake of the WeWork implosion, late stage startups are tightening their belts. The most up-to-date is one other Softbank-funded company, joining Zume Pizza (80% of crew laid off), Wag (80%+), Lovely (40%), Getaround (25%), Rappi (6%), and Oyo (5%) that comprise all gash crew to unhurried their burn rate and gash their funding needs. Freight forwarding startup Flexport that is shedding 3% of its world crew.

“We’re restructuring some substances of our group to dash sooner and with greater clarity and purpose. With that got right here the complicated resolution to allotment ways with round 50 staff” a Flexport spokesperson tells TechCrunch after we asked this day if it had considered layoffs worship its peers.

Flexport CEO Ryan Petersen

Flexport had raised a $1 billion Series D led by SoftBank at a $3.2 billion valuation a year ago, bringing it to $1.3 billion in funding. The corporate helps dash shipping containers corpulent of items between producers and outlets utilizing digital instruments in inequity to its ancient-college opponents.

“We underinvested in areas that reduction us support purchasers efficiently, and we over-invested in scaling our existing project, once we in actuality wanted to be agile and adaptable to most life like doubtless support our purchasers, in particular in a year of unprecedented volatility in world trade” the spokesperson explained.

Flexport serene had a epic year, working with 10,000 purchasers to finance and transport items. The shipping trade is so tall that it’s serene handiest the seventh largest freight forwarder on its high Trans-Pacific Eastbound leg. The massive headroom for enhance plus its mumble of tool to coordinate provide chains and optimize routing is what attracted SoftBank.

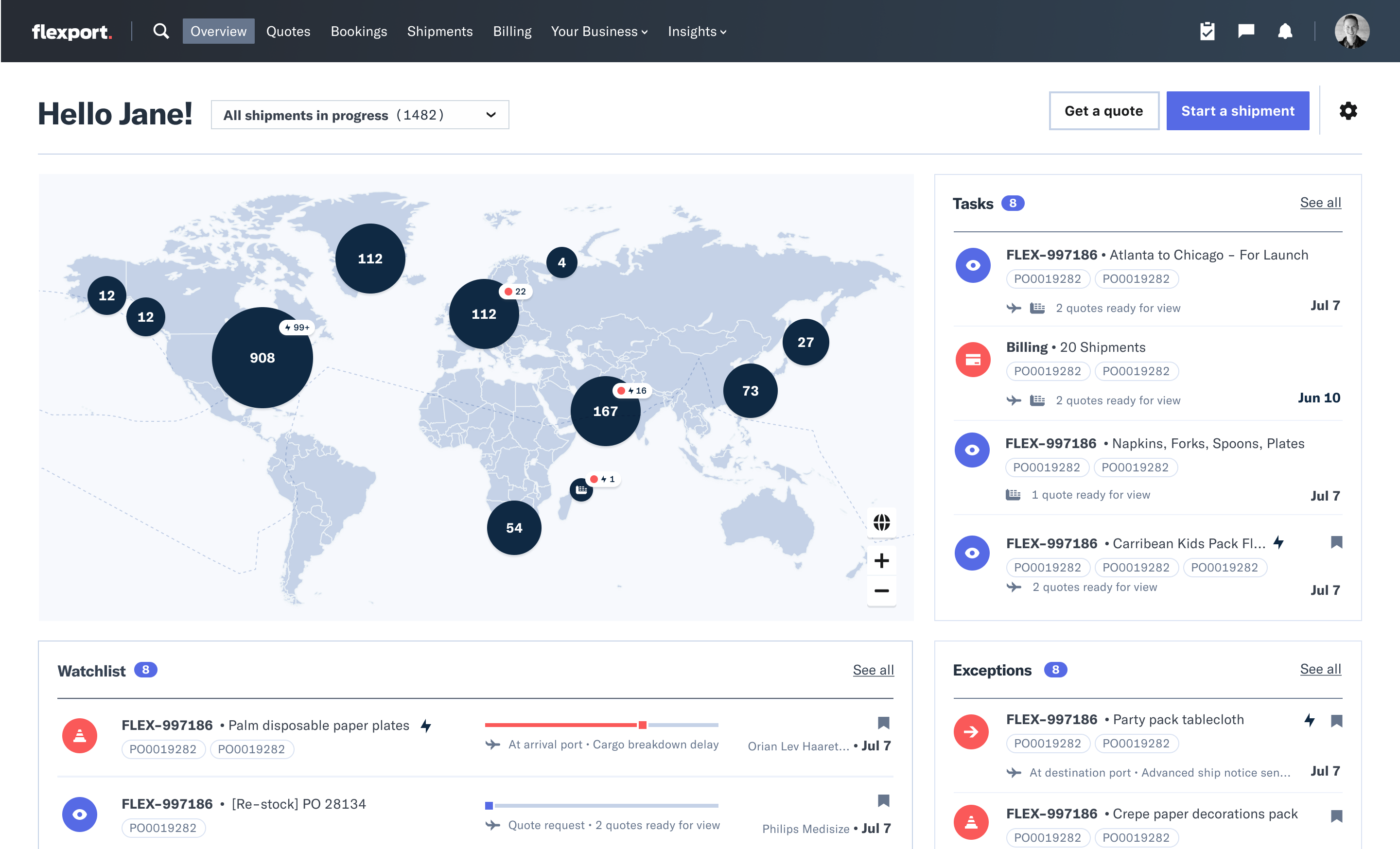

The Flexboard Platform dashboard affords maps, notifications, project lists, and chat for Flexport purchasers and their manufacturing facility suppliers.

Nonetheless many late-stage startups are scared about where they’ll obtain their next round after taking tall sums of cash from SoftBank at gargantuan valuations. As of November, SoftBank had handiest managed to expend about $2 billion for its Vision Fund 2 despite plans for a filled with $108 billion, Bloomberg reported. LPs were partly spooked by SoftBank’s reckless funding in WeWork. Additional layoffs at its portfolio companies might perchance perchance additional stoke considerations about entrusting it with extra cash.

Unless enhance stage startups can cobble together sufficient institutional investors to fabricate mountainous rounds, or thoroughly different tall capital sources worship sovereign wealth funds materialize for them, they might perchance perchance perchance now not be ready to expend sufficient to support instant burning. Those that can’t reach profitability or to find an exit might perchance perchance moreover face down-rounds that can reach with exhausting terms, situation off skill exodus death spirals, or trusty no longer present sufficient cash.

Flexport has managed to flee with trusty 3% layoffs for now. Being proactive about cuts to reach sustainability is probably going to be smarter than playing that one’s trade or the funding climate with by shock red meat up. Nonetheless while thoroughly different SoftBank startups needed to spend heaps to edge out converse opponents or fabricate up for frail on-demand provider margins, Flexport on the least has a tried and correct trade where incumbents had been asleep on the wheel.