When Nigerian angel investor Tomi Davies backed his first company — Strika Entertainment in 2001 — he admits he wasn’t conscious of his future feature.

“I became as soon as genuine serving to out mates. I didn’t perceive it became as soon as angel investing. I didn’t know there became as soon as a construction to it,” he said.

Seven years later, Davies got a 20x return on his first exit and a decade after that he’s identified as an architect of early-stage investing all over Africa.

Davies is President of The African Enterprise Angel Community and continues to fund and mentor younger tech entrepreneurs in multiple international locations.

On a name with TechCrunch, he shared advice for startups on fundraising, surviving COVID-19 and solutions for world merchants on coming into Africa.

VC in Africa

Davies’ ascendance in fundraising runs parallel to the boost in startup formation and VC on the continent over the final decade.

When he began In 2001, there wasn’t mighty measurable endeavor or digital entrepreneurial assignment in Sub-Saharan Africa, outside South Africa. Certainly, there became as soon as runt records on VC investing on the continent until round 5 years ago.

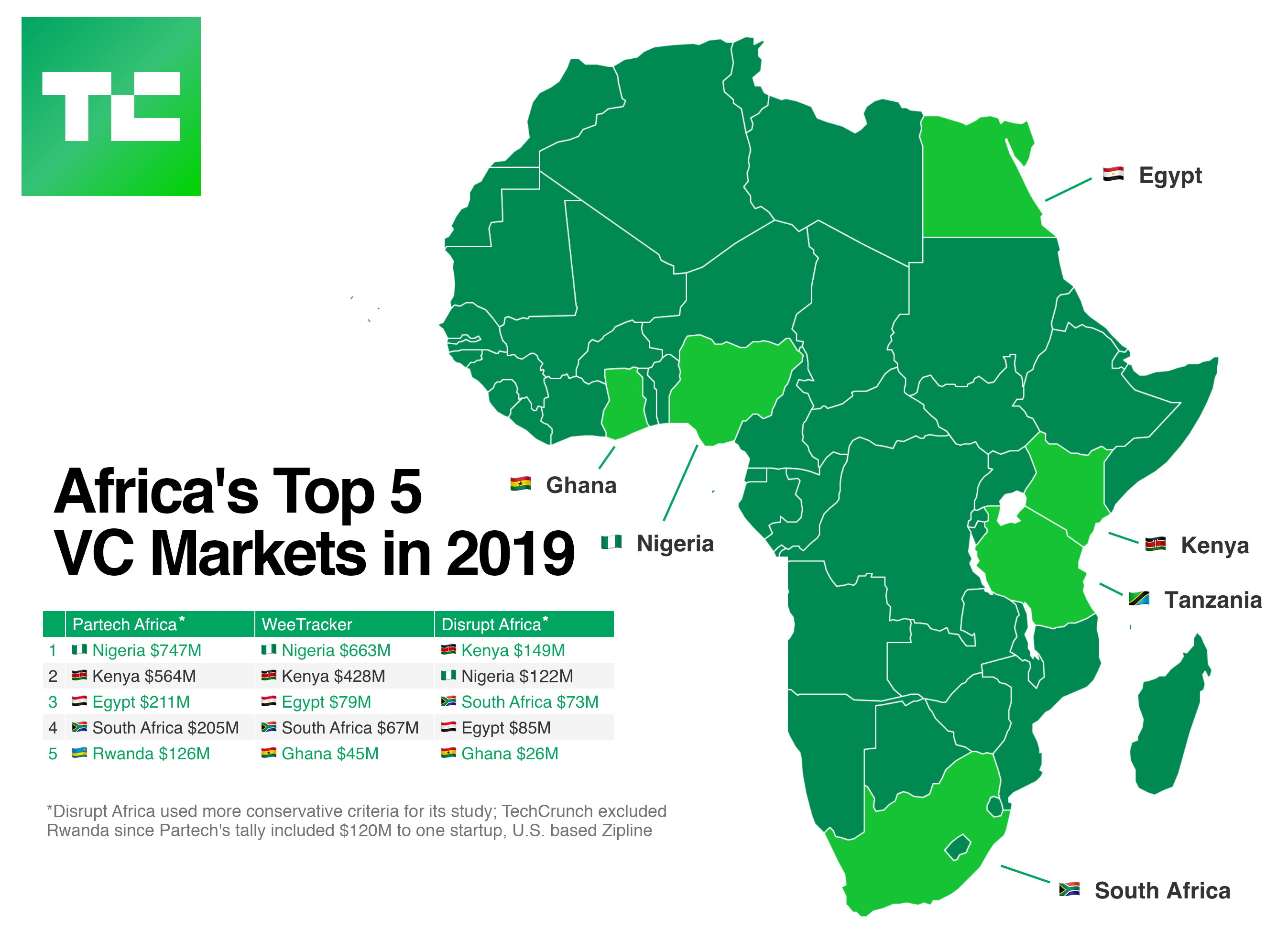

An early Crunchbase assisted blueprint estimated VC to African startups yearly grew from $40 million in 2012 to $500 million by 2015. A most modern evaluate by investment firm Partech tallied $2 billion going to the continent’s digital entrepreneurs in 2019, all over high markets Nigeria, South Africa and Kenya.

Image Credit: TechCrunch

There are now hundreds of VC backed startup entrepreneurs all around the continent descending on every that you may per chance possibly well take into accout utilize-case — from fintech to on ask electrical bike mobility.

Extra and more, Davies’ dwelling country of Nigeria has turn out to be the continent’s unofficial capital for endeavor investment and startup formation, given its market thesis of getting Africa’s supreme economic system and population of 200 million members.

Even with the boost in VC to the continent’s startups — which has drawn merchants similar to Goldman Sachs and Steve Case — for years panels at African tech conferences appreciate echoed the need for more early-stage funding solutions.

Davies has worked to fulfill that. He came to investing on the mates and family level after receiving an MBA on the University of Miami and an earlier occupation that spanned roles in management consulting, telecoms and IT.

After emerging as one of the predominant early angels to Africa’s startups, supporting the continent’s innovation ecosystem modified into a mission for the Nigerian investor.

“My raison d’etre modified into, and can live until the day I die, tech in African,” Davies said on a name from Lagos.

How you may per chance possibly well pitch

In his feature as President of The African Angel Enterprise Community, or ABAN, Davies has worked with a group to kind out a native investor web all around the continent.

“ABAN is terribly merely a community of networks…now we appreciate got 49 networks in 33 African international locations,” he outlined.

Those consist of Lagos Angel Community, which Davies co-essentially based, Cairo Angels and Angel Investor Ethiopia, presented in Addis Ababa in 2019.

Tomi Davies (L) judges pitches with Cellulant CEO Ken Njoroge at Startup Ethiopia 2019, Image Credit: Jake Spicy

ABAN establishes sure tips and requirements for how member networks operate, but every chapter sets its maintain investment phrases, constant with Davies.

For example, ABAN affiliated Dakar Angel Community — essentially based in 2018 to toughen startups in French talking Africa — supplies seed investments of between $25,000 to $100,000 to early-stage ventures.

The save and how startups leer funds from ABAN’s family of networks relies on the save they operate. “One ingredient I train to each person, from presidents to replace members to merchants, is Africa is set cities,” Davies said.

“Within the event you realize which city your taking a watch to make investments in or leer investment in, automatically we’ll be ready to recount, ‘right here’s your community.’”

For the Lagos Angel Community in Nigeria, the group has a pitch night time the third Thursday of every and each month with a 30 day rule. “Earlier than you permit, you’ll hear if we’re or no longer. If we’re , we’ve got 30 days to discover you an offer,” outlined Davies.

Recommendation to startups

Apart from his work with ABAN, Davies continues to make investments in his maintain portfolio of startups — now at 32 ventures — and is an on a typical basis seize on Africa’s tech competitors circuit.

He’s developed a framework to assess companies and shared factors of it with TechCrunch.

Tomi Davies (center) at Startup Battlefield Africa 2017

“What I train to any startup raising is the first ingredient any investor is listening to is how attain I discover my a refund. That’s ask most predominant, ‘How attain I discover my exit?,’” he said.

Davies confused out three issues to fulfill that ask: “The product carrier offering that you may per chance appreciate, the potentialities who search note in that product carrier offering and the nature of the connection by channel and note offering,” he said.

“That’s what you’re continuously tinkering with after you start with some more or less note proposition.”

Weathering recession

Davies referenced the elevated significance of referrals, given the coronavirus has cancelled a range of events and runt mobility to pitch in particular person in Africa’s high VC markets.

“As a result of COVID-19, networks appreciate turn out to be severely predominant. As a result of merchants can’t touch, can’t feel, can’t search [founders] members are taking a watch now for referential integrity, ‘Who sent me this deck?,’” Davies said.

On how a coronavirus precipitated Nigerian recession may per chance possibly additionally honest influence startups, Davies flagged the country’s non-break informal industrial assignment — and the adaptability of Nigerian entrepreneurs — as factors that will per chance well carry ventures by.

“There’s a essential chunk of the economic system that’s in the informal market. So even do that you must computer screen back on the recessions we’ve had…it hasn’t been felt on the streets,” he said.

Davies may per chance possibly be participating with partners on increasing working capital solutions for startups whose revenues appreciate been impacted by slowdown.

Co-merchants

Tomi Davies is enlighten about his favor to blueprint fresh partners from tech amenities similar to Silicon Valley, into early-stage investing in Africa.

“We’re continuously taking a search for co-merchants and I bid on behalf of all 49 networks in ABAN,” he said. Davies highlighted the native expertise every community brings to their market as a profit to VCs taking a watch to make investments on the continent by an African Enterprise Angel Community affiliate.