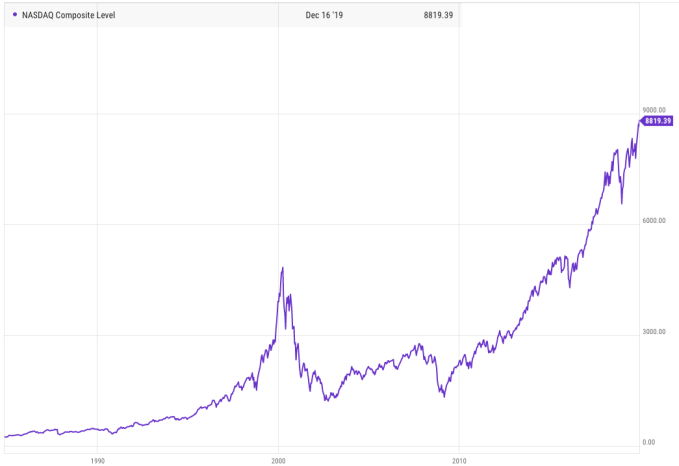

Today the tech-heavy Nasdaq Composite closed at an all-time record high of 8,814.23, up 0.91% on the day.

The Nasdaq is up more than 32% on the year. Turning the clock back, the Nasdaq Composite is up around 60% from the end of 2016. Compared to the anti-records set in 2009 during the doldrums that followed the 2008 crisis, the Nasdaq is up a staggering 594%.

The huge run in value of technology stocks since the last recession is historic. And, given the length of the current global economic expansion, somewhat lost on regular folks.

Times are good, and it’s worth reminding ourselves of how good. After all, the private markets — the world of startups, venture capital and the next big companies — follow the public markets’ lead. If we understand what’s going on with tech stocks, we’ll better understand what is happening with your local startup cohort.

Or more precisely, if you’ve been confused about why every startup is worth a bajillion (plus or minus) dollars, this is why.

A record run

Putting today’s Nasdaq level into historical context is a bit difficult. It has been so long since the last, lasting correction in the value of technology companies that their aggregate share price chart is simply up and to the right. Can you recall the last time tech stocks dropped real value, and stayed down?

Probably not. The reason why is that compared to the post-2008 expansion, the 2000-era technology bubble appears small, pathetic and short-lived. Via YCharts, here’s a look at the Nasdaq Composite going back into the ’80s:

That, in a nutshell is why there are so many unicorns in the market; that chart is why SaaS multiples are still around 10-11x ARR (per Bessemer, which is rebuilding its cloud index page at the moment). That chart is a part of why Uber’s valuation got ahead of its real value. It’s also why venture capital funds have gotten larger, private equity deals more expensive and SoftBank may raise a second Vision Fund despite a host of high-profile wobbles. It’s how Microsoft added mow than 50% of its total value this year.

You get the idea.

The stock market is incredibly strong right now, a fact that is pushing lots of private investors to pay more for growth in anticipation that companies’ revenue multiples will stay high (as dictated by public comps, or what larger companies are willing to pay for startups). So long as the Nasdaq keeps going up, that bet makes the punters look smart.

So what?

We could have written this post a few times in the past week, let alone this year. Of course, we can’t post a similar entry every time a tech-focused index hits a new record high — you’d fine it repetitive. But we also can’t not mention it every time, as it is critical to recall that today’s warm climate for startups is predicated on a public market trend that will not — cannot — last.

When will things change? No one knows. So far this December there’s no mini-crash to worry about. Things just look good, and healthy, and flush with new records.