After erasing more than $30 billion in projected shareholder value, Adam Neumann could walk away from the We Company with a windfall of as much as $1.7 billion, according to a report in The Wall Street Journal.

This is how the company will end, not with the pop of a successful public offering, but with a whimper from defeated investors probably tired after the months-long saga of trying to make sense of how a clever real estate plan ballooned into one of the greatest swindles in venture capital history.

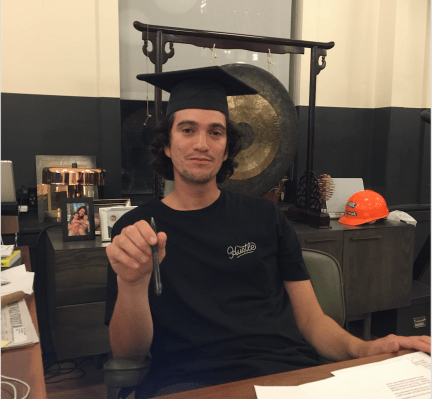

Already ousted as the company’s chief executive, Neumann controlled shares of the company that gave him what amounted to significant control even after his removal.

The We Company drama has it all. Complacent directors, horrible management, rapacious greed — wrapped in a package of holistic spirituality and the invention of a new kind of conscious capitalism. Even if it was ultimately a capitalism that was conscious only of its ability to deceive.

As Neumann leaves, SoftBank will gain control of the company it had once valued at $47 billion, but at a far more modest $8 billion figure. Still, the bid was more attractive to The We Company’s board of directors than a competing offer from JPMorgan Chase, according to the Journal’s reporting.

Under the terms of the deal, SoftBank will buy nearly $1 billion in stock from Neumann, who was already forced out from the company he co-founded as public markets balked over his managerial acumen. The Japanese conglomerate, which had pushed up the private market valuation of WeWork through its $100 billion Vision Fund, will also stake Neumann $500 million in credit to repay a loan facility and give him a $185 million consulting fee. As a result, Neumann will now be on the hook to Softbank for the loan.

Even with the Hindenburg-level catastrophe that Neumann piloted as the chief executive of the money-losing real estate venture, the former chief executive will still retain a stake in the company and remain an observer on the board of directors.

In all, SoftBank is putting in a tender offer for as much as $3 billion to go to the company’s employees and other investors. In fact, WeWork needs the money to be able to afford the layoffs it reportedly wants to make as it tries to right the ship.

People with knowledge of the company’s plans said the decision could be announced today, according to the Journal’s reporting.

Part of the reason for the $500 million loan was that Neumann’s removal from the executive role at the company risked putting him in default with his JPMorgan loans.

WeWork revealed an unusual IPO prospectus in August after raising more than $8 billion in equity and debt funding. Despite financials that showed losses of nearly $1 billion in the six months ending June 30, the company still managed to accumulate a valuation as high as $47 billion, largely as a result of Neumann’s fundraising abilities.

“As co-founder of WeWork, I am so proud of this team and the incredible company that we have built over the last decade,” Neumann said in a statement confirming his resignation last month. “Our global platform now spans 111 cities in 29 countries, serving more than 527,000 members each day. While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive. Thank you to my colleagues, our members, our landlord partners, and our investors for continuing to believe in this great business.”